How To Buy A Home In A High Interest Rate Market

Hoping to buy a home this fall, but struggling to justify the purchase in the face of high interest rates? At The Jenn Smira Team, we’re all about finding creative solutions to make your homebuying dreams possible, and we’ve got great news: A temporary buydown might be the perfect answer for you.

First things first…what is a temporary rate buydown?: Seller-paid and lender-paid temporary rate buydowns that help borrowers lower their interest rate for the first 12 to 36 months of their mortgage. Today, temporary buydowns appeal most to home buyers looking to transition from a lower interest rate/cheaper rent without depleting their savings on the down payment or closing costs in the process — money that could be used instead to replenish savings or spent on home upgrades.

How does it work?: Either seller concessions are used to pay the upfront fee with a seller-paid temporary rate buydown, or a lender-paid LLPA option can be used to cover the buydown cost.

Benefits Of Buydowns (For Buyers And Sellers):

– Buydowns are a great way to sell your home without impacting the list price when interest rates are high, since the benefit goes directly to the borrower.

– This strategy allows borrowers to leverage any excess seller concessions that often go un-utilized.

– A lower interest rate for the first 1-3 years ensures the borrower will have a lower monthly payment, empowering them to put the money towards renovations, upgrades, or new furniture.

– When buying down in a high interest rate environment, borrowers will more than likely be able to refinance to a lower rate than the one they will adjust to after the 1-3 years have passed.

– Buydowns make for a smoother transition from renting to buying by easing the borrower into their mortgage with a lower starting payment.

➤ Do you have more questions about buying a home in DC? Read these posts next:

- How to Make Your Offer Stand Out

- How Many Properties to Tour Before Submitting an Offer?

- How to Help Your Child Buy a Home

Your Lending Advisor: When it comes to something as important as your financial future (and present), we refuse to take shortcuts. That’s why, over the years, we’ve built a partnership with Patti O’Connor of IntroLend Capital Mortgage. At the end of the day, Patti isn’t just your lender — she’s the advisor who will be by your side when the time comes to refinance as rates decrease down the line.

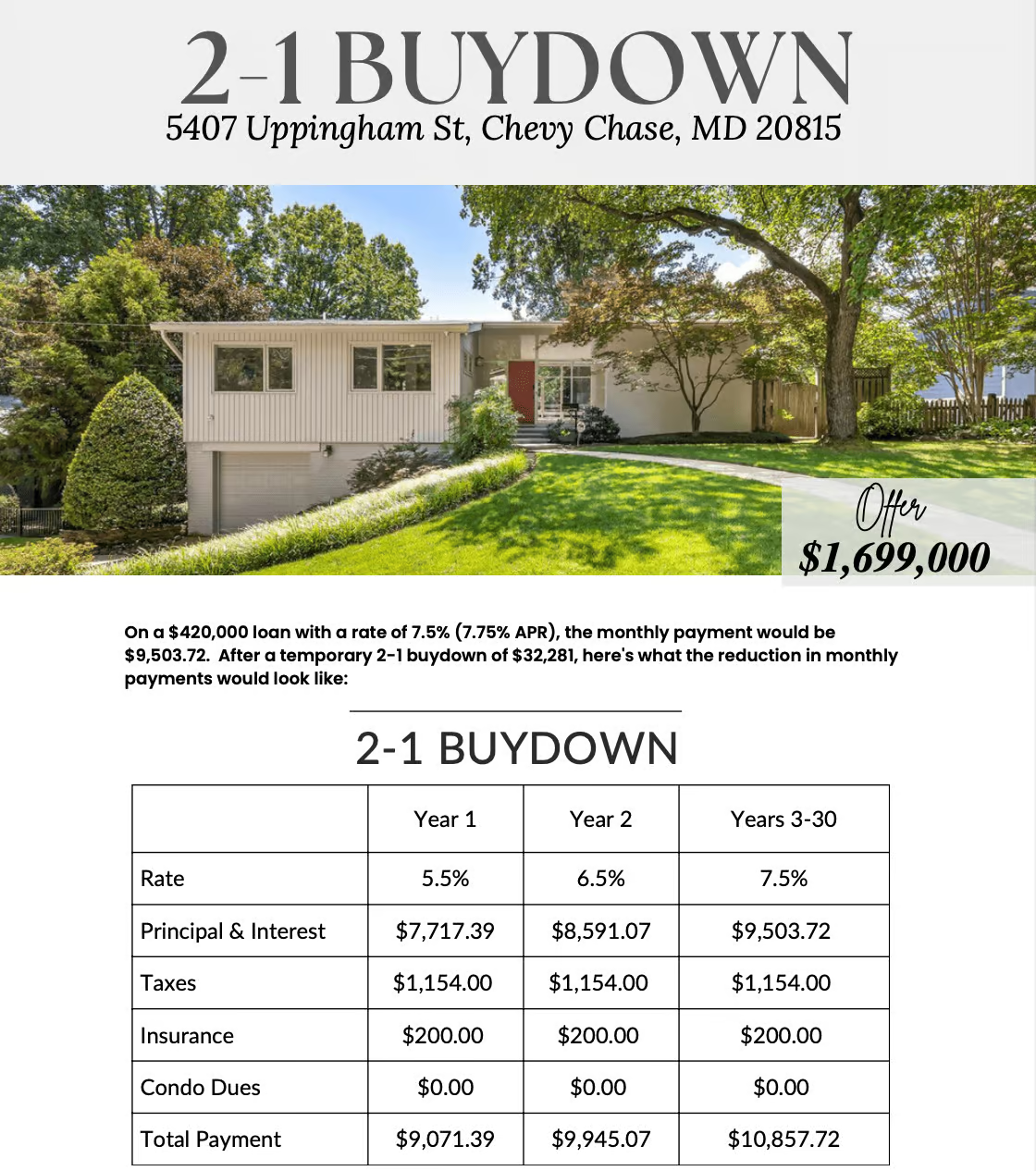

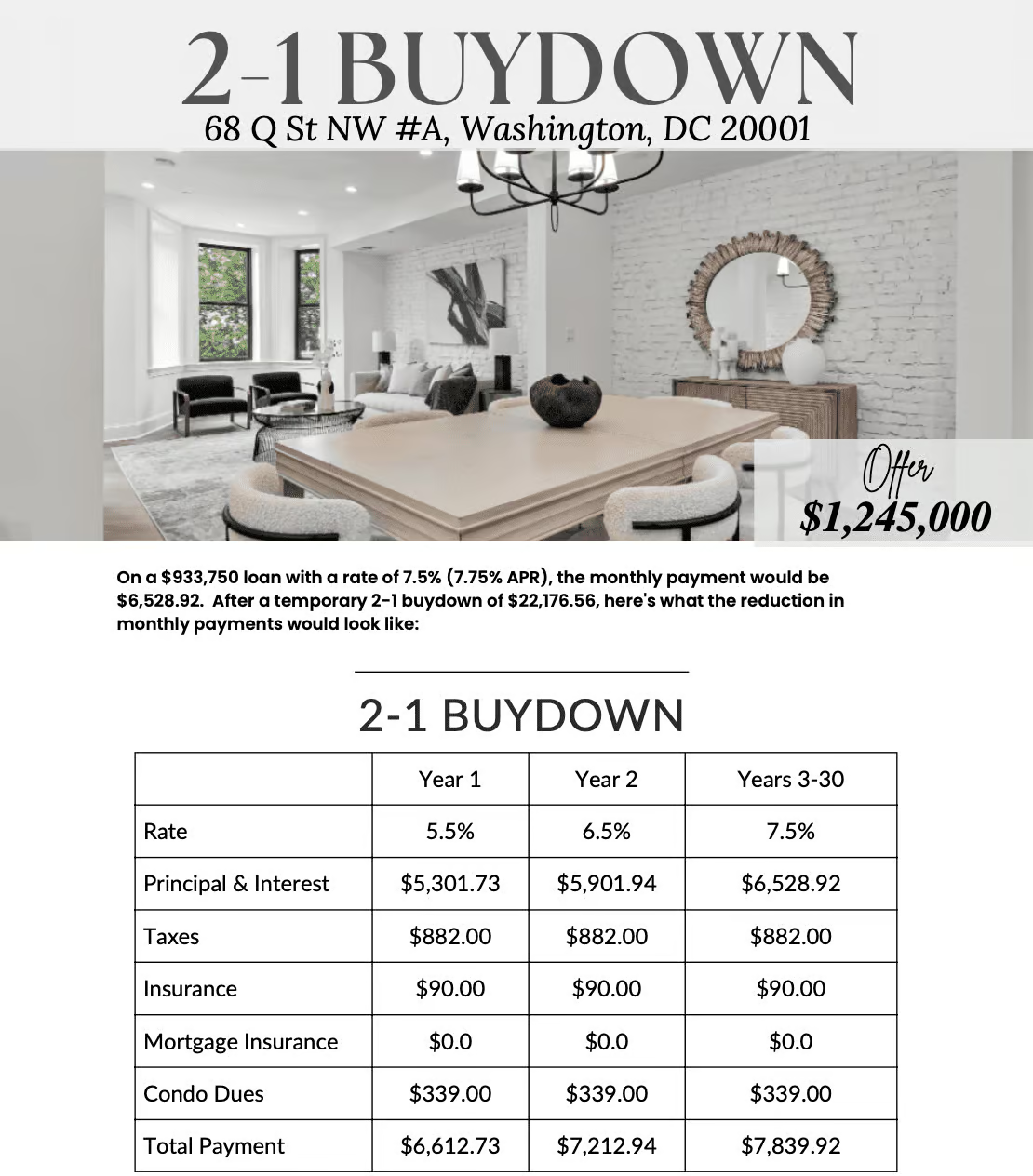

Curious to see the power of Patti’s expertise in action? Check out these two real-life examples of how buydowns are helping clients today achieve their homebuying dreams.

In the example below, the buyer is saving $1,786.33 a month the first year. By 2025, economists are currently projecting rates to drop to as low as 4.5%, which means that it’s possible for this buyer to have their perfect home and refinance to a great rate. Even better? Any leftover credits that were originally allotted for the temporary buydown will roll over to pay down the principal of the loan: another win for the buyer! Plus buy now with less competition! When rates drop we are anticipating high demand and even some market frenzy.

In the second example, there is an estimated savings of $1,227.19 the first year on this luxury condo downtown. So whether you’re debating between that single family home in Maryland or a swanky condo in the heart of the city, a temporary buydown can be the key to driving down the rate for 2-3 years — no matter which path you choose. Of course, Patti O’Connor from IntroLend Capital Mortgage will be in touch when the time is right to refinance, meaning you can rest assured and take a break from monitoring the market weekly!

Curious to learn more about the difference buydowns could make for you in your next home purchase? We’re here to help. Reach out today so you can meet your new homebuying team! Give us a call at 202.280.2060 or email us directly at jsmira@jennsmira.com today!

Put Us To Work For You

Book a consultation with our team today.